Simple Set Ups Create Popping Profits for the Energy Sector

Trading XOM and CNQ as the Energy sector starts to heat up.

Opportunities seems to be the best for the technology sector or semiconductor stocks with moves that could make anyone blush.

The trick with trading these highly volatile tickers is you have to be willing to accept bigger losses. And as with everything, you measure success by adding wins and losses together.

Ultimately, you are trading names that give outsized returns but also create outsized losses and you have to be a disciplined trader to profit consistently.

We trade these higher beta names regularly.

Currently we have MRVL call options expiring in June that are up over 52% with 37 days until expiration.

TSLA call options netted a quick 106% in a day.

I am not saying the tech or semiconductor names should not be traded. They absolutely should. But there are other, sneakier opportunities.

The energy sector is where I am seeing the next big move and it just started.

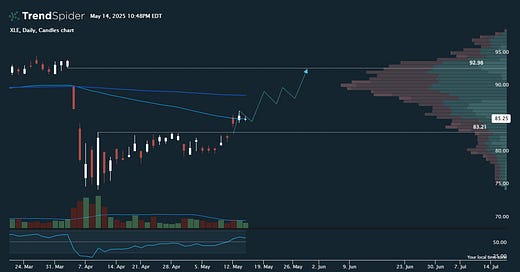

Take a look at this chart for XLE, the energy sector ETF I track.

The candles for XLE bumped up against the 83.21 resistance level multiple times before finally breaking through this week and meeting the 50-day simple moving average (SMA).

After a few days of consolidation at this SMA I expect shares to continue higher towards 92.98 which is a solid line of resistance. There could be another pause just below 90 where the 200-day SMA slides in.

There are two gaps above for XLE to fill and it looks like that is exactly what we are going to get. The relative strength index (RSI) is also back above 50, showing signs of strength and momentum.

With that in mind, I picked apart my energy sector watchlist for another set of trade ideas. I like the way these charts set up. Very clean. Very simple to trade.

If you missed it, I handed out all of my watchlists in the post Watchlists for Traders - Saving You Time. Be sure to check it out. It is a great foundation of tickers for any trader.

One of those watchlists is for the energy sector, here are some of the names that make up that list: XOM, OXY, CVX, COP, ET, DVON, VNOM, CNQ, BP, KMI, APA, BKE, SLB, EOG, NVT, and PSX.

XOM might sound like the obvious choice because it is the largest holding in XLE, but that is not the reason it is one of the trades I am considering.

The chart for XOM sets up with a simple, zero nonsense trade. We will know which direction to take by the end of the week.

CNQ is a lesser-known name for retail traders, but the options volume is there and this is another chart that allows for quick, simple decision making.

And now it is time to get to the charts and the trading plans.

Keep reading with a 7-day free trial

Subscribe to A Trader's Education to keep reading this post and get 7 days of free access to the full post archives.