Watchlists for Traders - Saving You Time

Tickers I am trading, my top interest list, and favorites for each sector.

I aim to bring you more than just fantastic trade ideas every week. The tips and tricks learned over decades of working and trading are also meant to be shared.

All of them.

So let’s get right to it. This one is a real time saver. You can change, update, delete these lists to fit your style but getting them is a great starting point.

I am talking about “borrowing” watchlists from others. Or flat out stealing them.

I have written about this before but my lists have been curated since then and it seems like a good time to share again.

The question is often asked, “what stocks do you trade?” Sometimes it is phrased a little differently, but the intent is always the same.

How do I find the right stocks to trade?

The system I use is simple, takes very little time, and narrows the list of charts to review down to a very manageable level.

First, I start with what I am familiar with. The stocks I enjoy trading the most.

I have included my list of favorites, the “ATE Watchlist” is the creative name I gave this bunch of tickers. I review all 67 of them (my last count) every week. But that is a lot of work!

That said, I know these stocks have liquid options. Often they have weekly options to choose from but at a minimum, the volume in the monthly contracts are sufficient to keep the spread between the bid and the ask fairly small.

Perfect for swing trading.

Another approach I take is to review my “Sectors” watchlist, which is a collection of sector ETFs (plus SPY, QQQ, SMH, and a few more).

(Don’t worry about copying this image, there is a link to all of the watchlists a little further down the page.)

This gives me a quick understanding of which sectors are trending or are attractive for a long or short.

When I have a sector or two identified, I grab my watchlists for these respective sectors and start reviewing the charts within the space.

For example, if the chart for SMH is showing me something I will turn to the watchlist I have created for my favorite semiconductor stocks to trade.

If SMH is breaking out, I am going to review top holdings like NVDA, TSM, or AVGO. I will also skip past semiconductor charts that are moving in the opposite direction, focusing my time on charts that are moving with the sector.

While I am reviewing these charts each week, I hand pick a few names that are nearing levels of interest but are not quite there yet. This creates my “ATE Interesting” watchlist.

If I am in a real pinch for time, the ATE Interesting watchlist is my go-to. Never more than a dozen or so stocks on it and all of them interesting.

Here is a link to every watchlist I have. The ATE Watchlist, ATE Interesting, ATE Trade Ideas, Sectors ETF, and all sectors watchlists. Enjoy!

All 23 ATE Watchlists ← (another link to the watchlists)

If you have TrendSpider, let me know! I can share my watchlists directly and it updates in real time so you will get any and all updates I make to these lists.

If you do not have TrendSpider yet, be sure to check it out. If it interests you, please use my affiliate link if you do not mind: Get me TrendSpider!

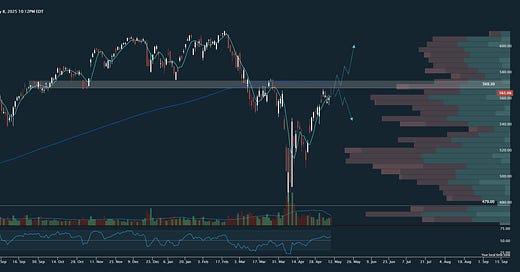

With SPY testing 570 (I am a broken record at this point) we are at a very interesting spot and could see big breakouts or equally big rejections.

This chart really says it all.

This weekend will provide plenty of time to review the ATE watchlists to find quality setups ahead of what looks like a major decision point for the broader market.

Those in the chat know I am in TSLA June 20 call options and am looking for more upside! We are building a community and hope to see you in there.

Close out the week strong and enjoy the weekend ahead! I hope you enjoy the watchlists and if you come across any interesting charts, I hope you share them!

All 23 ATE Watchlists ← (one last link to the watchlists)

-Nate

I am an affiliate because I use and benefit from the tools they provide. Anchored VWAP is just one of the many top features I utilize every day. Check them out!

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

Here’s a simple truth: if you’re not using watchlists, you’re wasting time and burning energy.

Watchlists let you filter noise, stay prepared, and focus only on the setups that matter.

Thank you!