Let’s do quick run through of the positions in my Savvy Trader portfolio (all green Thursday, very nice) and what to expect from here.

This small, swing trading portfolio is up 16.85% for 2023.

You can subscribe and keep up with every trade for free here.

And now to each holding and a chart or two.

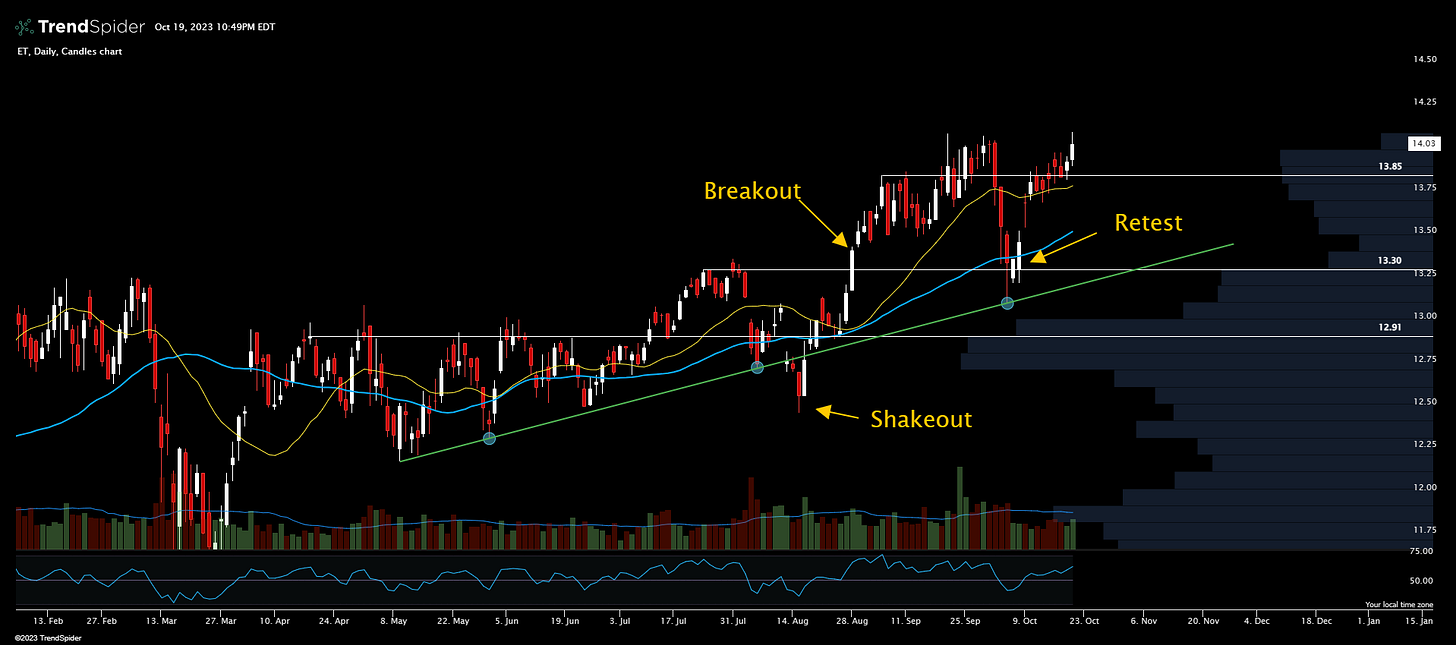

ET

Energy Transfer, ticker ET, touched $14.10 on Thursday.

This is a penny above its recent high and I like it to continue higher along with the energy sector in general.

There are few charts that look as nice as this one. I am considering adding to the position if it breaks above $14.10 meaningfully.

ET is not great for selling covered calls, which is part of the focus in the portfolio.

ET brings in about 1% for calls sold at the $14.50 strike and that is if you go out 43 days to the Dec 1st expiration date.

I prefer more premium, especially when I think shares are likely to move higher than the strike price.

CPNG

CPNG on the other hand can bring in a nice premium right now.

Selling covereed calls at the $18.50 strike, with the Nov 10th expiration date brings in about 3% with room for shares to still rise.

There is an additional 4.5% of runway from Thursday's close to the strike price.

I like this trade.

I also like CPNG to make a move higher after bouncing nicely off of the 20-day simple moving average (SMA).

AMD

AMD stalled out a bit but is holding the line at $102.

Targeting a push to the next volume shelf above at $107.50 it was good to see a positive Thursday when every other semiconductor name sold off, including NVDA.

Implied volatility is high for AMD, selling cash secured puts at the $100 strike with the Nov 10 expiration brings in $435 as of Thursday's close.

That's 4% in three weeks. Not bad.

I hope you are all having a profitable week. Close it out strong!

Thanks for tuning in! I appreciate your support of A Trader’s Education and hope you have a great day!

If you enjoy the podcast, be sure to watch live every Sunday on YouTube where I host The Trading Triangle with friends Shaun and Kaye.

Also check out the A Trader’s Education Newsletter for weekly breakdowns of trading strategies and trade ideas.

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

Share this post