It is Time to Trade TSLA Again

Trading a channel break. Plus, AAPL at support and looking for a bounce.

Channels form and when they do, trading opportunities are created in abundance. We can see that with both TSLA and AAPL, with two different types of trades.

The bigger the time frame, the more confidence I have in the levels the chart presents and that is why I am diving into the weekly charts for both of these names.

The candles show clear channels that have formed. A channel is a clean way of saying there is a range that is being trade between strong support and strong resistance.

Why is this important?

When either side of the channel is broken, it is usually significant. One side, the bulls or bears, has finally broken through.

The ideal trade sets up when this level is then retested. That is the prime entry for any trade because the risk is clearly defined.

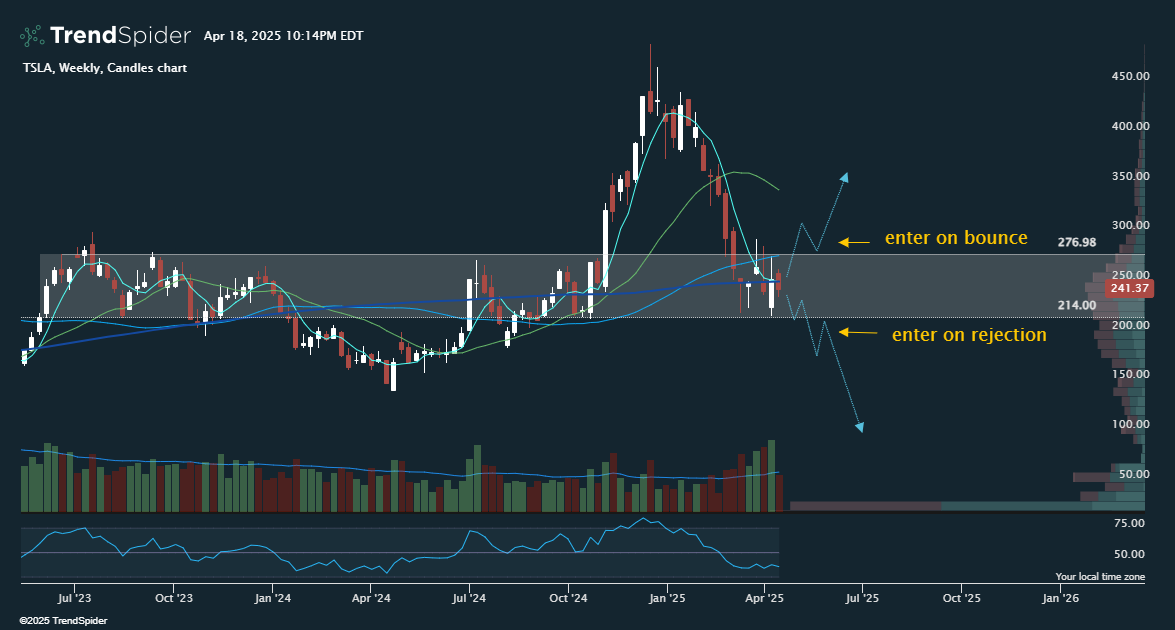

Take a look at this weekly chart for TSLA as an example.

Resistance near 277 forms the top of the channel and support near 214 slides in as the bottom of the range.

If we see a clean break above 277 it is tempting to jump in right away. Sometimes this is the only opportunity you get.

The better entry is on a retest of 277 as depicted in the chart above. Waiting for the bounce reduces your risk and allows you to use prior resistance (277) as your stop loss once you have entered the trade.

The same can be said at the bottom of the channel. If shares drop below 214, entering on a rejection at this level after the candles retest it is ideal.

The weekly chart for AAPL shows the key level is 198, which is at the top of the channel that formed between July 2023 and June 2024.

I am expecting the bulls to try holding above the channel, allowing the candles to continue higher from here after quickly slipping in and out of the range two weeks ago.

If the candles fail to stay above this level, look for a retracement to the bottom of the channel near 170.

It is not uncommon for the lows to be tested before the next move higher. That is exactly what the chart above for AAPL shows in October 2023 and April 2024 before breaking out.

We could see 170 retested before any attempt at a move higher. This would be another excellent trade set up with clearly defined risk.

Here are the options contracts I am considering, profit targets, stop loss levels, and complete trading plans for both TSLA and AAPL.

Keep reading with a 7-day free trial

Subscribe to A Trader's Education to keep reading this post and get 7 days of free access to the full post archives.