Goal $1.4 Million: Step 3 of 4 - Selecting Options

A simple options strategy you can understand and utilize to build your account.

This service is for general informational and educational purposes only and is not intended to constitute legal, tax, accounting or investment advice. These are my opinions and observations only. I am not a financial advisor.

I hope you had a nice start to the month of April, both in life and at the trading desk.

Markets continue to move sideways and our trading strategy is proving to be powerful.

It is no doubt a great time for collecting cash by selling options.

Last week we dove into selecting stocks. This week we get into a topic that many shy away from or are flat out afraid of.

I’m here to show you it does not have to be complicated or a high risk venture. Instead, trading options can be a great way to generate cash consistently.

If you have not had a chance to read the first two parts of this four part series, I recommend you take a few minutes to read “Step 1: Getting Started” and “Step 2: Selecting Stocks”.

I would also like to take another opportunity to thank the paid subscribers to A Trader’s Education. You all are the best!

I thoroughly enjoy writing and teaching and hope to bring a ton of value every week. Your support and interest is appreciated.

And now for this week’s value!

What is a Covered Call?

The covered call strategy is how I am generating cash every week against the shares I own. It is a great way to learn about options while trading.

This strategy adds to returns while offsetting risk and it works very well in markets that move sideways, like the one we are in.

It is also fairly simple.

To start, you need to own 100 shares of a stock. This is why stock selection is so important. You want to buy shares of stock at the low end of a range or the start of a nice technical set up (the chart has a lot of signs indicating the same thing).

When you select and sell a call option for the same 100 shares you own, you are engaging in the covered call strategy. What does this mean?

Selling a call option obligates you to sell 100 shares of the underlying stock of the option at the strike price indicated by the option. And this can happen at any time before the expiration of the option.

Examples work best so let’s look at one.

RKT - Rocket Companies, Inc.

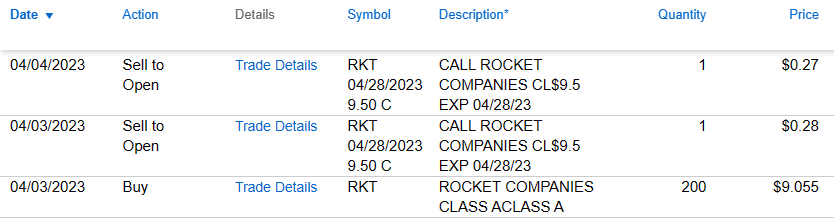

I recently bought 200 shares of RKT for a total of $1,811 ($9.05 per share) and sold two call options against those shares. Two covered calls.

The calls I sold were the $9.50 strike price expiring April 28th and I collected $53 (after fees), which equates to an immediate gain of +2.9%.

The math: $53 / $1,811 = 2.9%

So, I was able to collect nearly 3% immediately. And no matter what happens with the stock price, the gain from selling the option is always yours to keep. Or in this example, mine!

The obvious (or maybe not so obvious) benefit here is I now have protection against losses in my shares of RKT for up to the $53. The share price can drop from $9.05 to $8.78 and I would be even on the trade.

There is a trade off, and what you are giving up are the outsized gains. There is a limit to your upside profits when you sell covered calls. Allow me to explain.

If the shares of RKT move up, and I hope they continue to, they could move above the $9.50 strike price. This would be great! Profits!

The shares could continue to rise to $10 but because I sold covered calls at a $9.50 strike price, I can only sell the shares for that strike price and I can only sell them to the owner of the option. That is the trade off.

When a call is sold, you are selling the obligation to sell 100 shares of the stock involved at the strike price of the call option. In this case it would be RKT at $9.50.

So if the shares of RKT do get to $10 what happens?

I get to keep the original $53 collected from the sale of the option plus the gains from selling the shares at the $9.50 strike price. That equates to a nearly 8% gain in a few weeks.

And remember, that gain came with downside protection of about 3%. That is good risk management.

If the shares of RKT climb to $10 I will miss out on some of the total gains which would amount to 10.4% but they come with zero downside protection.

Currently, RKT shares are moving sideways to slightly up. This is where things get really interesting.

If the shares do not rise above $9.50, the covered calls will decline in value and there is an opportunity to “buy back” the options at a lower price.

Why would you do this? To allow yourself the chance to sell another round of covered calls and collect more cash.

Continuing with RKT as the example. If the share price is less than $9.50 or only slightly above when we get near the expiration date of 4/28, I will buy back the covered calls for a few dollars and then sell two more covered calls that expire at a later day. Likely in May.

That is more cash collected!

I could also just let the options expire worthless and sell a new round of covered calls the following Monday. That works just as well.

This process of repeatedly selling calls against the shares you own can generate a lot of cash over a short period of time. Truly ideal in a sideways market.

The shares of RKT could continue to drift slowly higher or remain flat. By selling covered calls, I can collect 3% every few weeks while those that just own the stock are making no money.

This strategy is also ideal in a down market if you’re holding your shares for the long term and want to offset losses in the near term.

The only time this strategy severely lags the markets in general is when the markets are ripping higher and at a fast past. When this happens, I simply trade stocks without selling options against the shares I own.

So how do I select each option to sell? What price? What expiration date?

The process is really much easier than you might think.

Selecting the Strike Price

Trading options requires you to select a specific strike price and expiration date. So what does that mean?

The strike price is the price the owner of the option is able to pay if they “exercise” the option. If the shares are above the strike price, the owner of the option is able to buy at the strike price which is effectively a built in discount.

There is a price to pay for that discount and the more likely the option is to be exercised, the higher the price of the option.

If you are the seller of a call option, which is exactly what we are, you want to maximize the cash you collect for each sale. The premiums collected can add up!

I first look at a chart to understand where a stock has hit resistance in the past. This is a good way to identify strike prices because the shares will typically slow down and stall out near resistance, allowing time for the option to expire out of the money.

Definition: Out of the Money - when a stock’s price is below the strike price of a call option it is considered “out of the money” because the option is worthless. It makes more sense to just buy the stock at the cheaper price.

Continuing with the RKT example, the levels of resistance above my purchase price of $9.05 are at $9.50 and then $10.25.

This tells me to look at call options with strike prices at $9.50 and $10.00, possibly $10.50.

Taking a look at the options chain for RKT, I want to focus on the $9.50 and $10.00 strikes to start but also want to look at deltas and duration. This is where the expiration date comes in to play.

Selecting the Right Expiration Date

As a rule of thumb, I try to get as close to 1% gain for every week to ten days of duration for any covered calls I sell.

For a $9.05 stock, which will cost $905 for 100 shares, I am targeting a call option sale for about $9 with an expiration of less than two weeks away. Preferably just one week.

However, the 1% target is just a guide. You need to have multiple points of information line up correctly to maximize gains.

This starts with looking at strike prices that have between a 0.20 and 0.30 delta.

Yes, I started mentioning the greeks. It is important to take time to learn what each represents and perhaps that will be the topic of a future newsletter. However, it is not required for this strategy so I won’t deep dive it here.

Definition: Delta - measures how much the option price will move relative to every $1 move of the underlying stock. So for a call option with a 0.20 delta, every time the stock move $1 the option price will move 20 cents in the same direction.

For now, just know that after you use a chart to locate the strike price you should start looking to see if call options with these strike prices are within this suggested delta range, which again is 0.20 to 0.30.

I like to start with the nearest expiring options and work my way out when analyzing which option to sell.

For RKT, the options expiring one week out at the $9.50 and $10 strike prices were outside of the optimal delta range and did not quite align with the 1% target.

When I started to slide out in weeks I liked the alignment for the April 28th expiration date. The options were in the desired delta range, provided a near 3% return for a 3 week time horizon, and were available at the $9.50 resistance level.

To summarize, the call options I like to sell are:

Near or above resistance levels

At a delta between 0.20 and 0.30

Providing close to 1% per week of duration

If you consistently locate stocks that have options with these characteristics, you will set yourself up to collect cash with trades that have a higher probability of success.

Recap and Look Ahead - The CCS Portfolio

The covered call strategy is simple and effective and I continue to utilize it in the CCS Portfolio with a lot of success. I add a little twist by focusing on growth stocks within the covered call portfolio.

I call this the Calls on Growth Trading Strategy.

You can follow the stock trades I make in near real time by subscribing for free to my portfolio on Savvy Trader. Unfortunately, it does not have the ability to track my options trading or my trading plans and thoughts.

ANNOUNCEMENT:

I am launching a discord room in May that will allow you to see every trade I make in real time, both stocks and options.

You will have complete insight to how I manage my account. Every trade, every plan, every thought.

I don’t have hours and hours of time to spend every day staring at a screen and I am guessing you don’t either, which is why I am so excited about launching this next level of trading education about the Calls on Growth Trading Strategy.

The Calls on Growth Trading Strategy requires less than an hour a day of screen time and allows for active trading, every day.

This is not some plan with constant updates every second, alert filled, YOLO trading nonsense that keeps you glued to the screen all day.

This is real insight into how I manage my trading account, which is a style that allows for active trading around a 9 to 5. I am showing EVERYTHING and in real time.

Here’s what you can expect.

Portfolio transparency- track how I manage my accounts, every trade

Daily premarket preparation - my daily trading plan write ups and live calls

End of the day trading wrap ups

Weekly live calls - ask me anything! I'll talk trades that worked and those that didn't. Plus a look ahead to the following week.

Weekly and monthly trading plans

Technical Analsyis of over 20 tickers - All of my annotated charts, trade ideas, and trading thoughts updated daily.

Sector Reviews

Contests and Giveaways (mystery chart, trade of the month, free subscriptions)

Access to a Trading Education library - videos, checklists, step by steps

A community of traders!

Let me know what questions you have! More to come as I open up the room later this month for early, discounted access.

Ok let’s get to next week’s trading!

SOFI

Last week I picked up 200 shares of SOFI. For those that have been following all year, you’ll note that this is the second time around with this stock.

The first time I traded it the shares took off on strong earnings and the shares were called away (I was forced to sell them at the strike price).

Many people do not like this because they fear they will never get another opportunity to buy the stock again at lower levels. This is simply not true.

Many times, profit taking drives the stock back down after a big run and that is exactly what has happened with SOFI.

I like the 20 and 150 day Simple Moving Averages (SMAs) providing support below the bullish pin candle that formed Thursday.

I sold covered calls at the $6.50 strike price, expiring 4/21 and expect the shares to make a run at the 50-day SMA which is currently at $6.30.

That would establish a new recent high and would put the MACD in a firmly positive position.

CPNG

I like CPNG to bounce here after getting near the 50-day SMA before bouncing Thursday to close the week.

The 150-day SMA sliding in above right at the $16.81 resistance level provided a tough ceiling last week and I expect it to be tough when the shares test it again.

I have sold calls twice against my 100 shares, collecting $35 which is +2% in the account for my trade in CPNG in just 5 days.

RKT & MARA

I will look to either add to RKT or get back into MARA with the additional cash in the CCS account.

I might be buying another 100 shares of RKT if they drop below $9.10 and hold $9.00.

I like MARA between $7.50 and $7.70 if it looks like it is holding $7.50. The 150-day SMA above might knock it back down quickly, which means considering selling calls closer to the current share price is an option.

Of course, Bitcoin will really be what drives MARA the most. And if markets drop, lately the tendency has been for Bitcoin to strengthen.

We will see how things shake out. SPY is already at $409 with tough resistanace at $411 and then again at $420 and $432. The markets could drive lower.

Twitter Spaces - Chart Reviews, Trading Strategies

Quick reminder and big thank you to everyone that tunes in!

We are taking this week off and will resume the following week with an improved format. I think you will like it!

You can always find recordings of past chart review sessions in the podcast section of the A Trader’s Education library.

Ok that is everything I’ve got for this week’s newsletter. Next week we will wrap it up with part 4 of 4 - Executing the Plan. This is where it all comes together!

Best of luck to everyone this week. Trade wisely.

-Nate